100+ Cash App ATM Locations (+How to Withdraw for Free)

We foster relationships with brands we use and trust. The testimonials on our site represent real experiences, but they don't guarantee you'll achieve similar results. When you make purchases through our links to our partners, we may earn a commission. Your support helps us continue this work. You can read our full disclosure here.

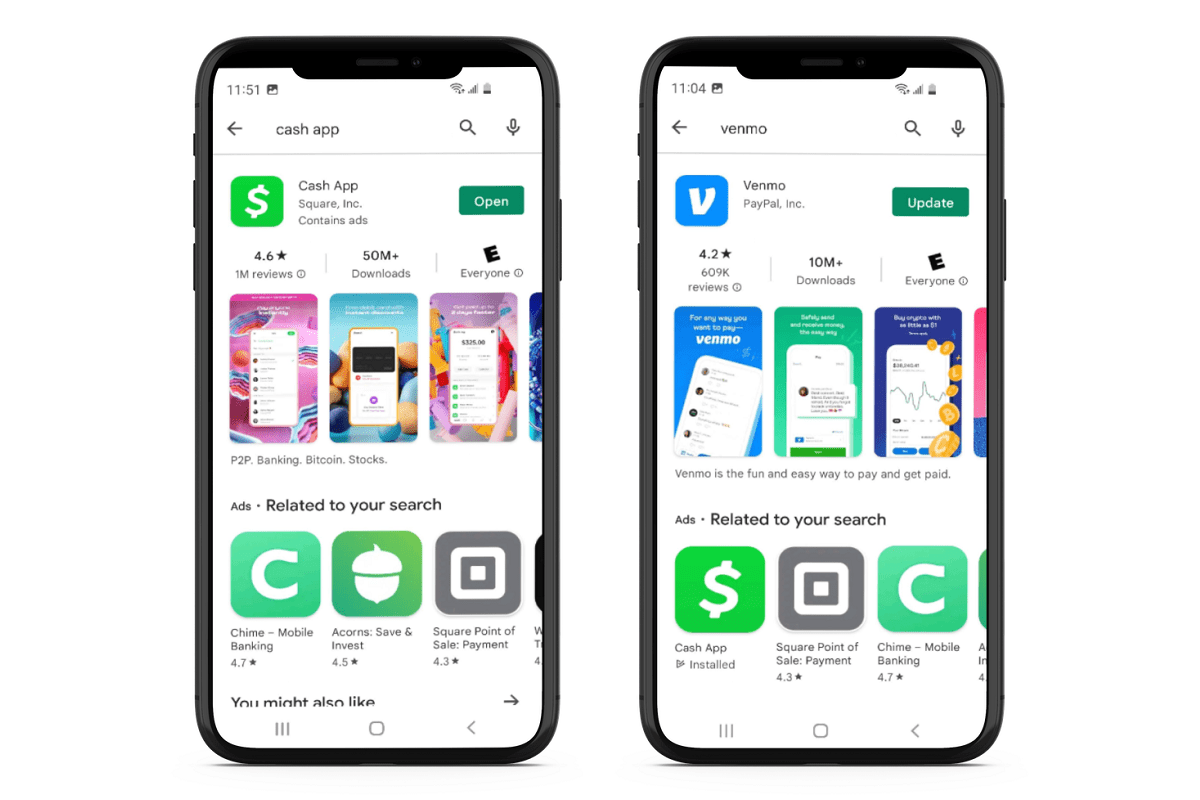

When I first downloaded the app, I was concerned that finding a Cash App ATM near me would be difficult. Trusting my money with any new company starts with learning how to access my funds when I need them.

Would it be hard to withdraw my money from Cash App? Are there withdrawal limits to consider? Where can I go to withdraw my funds? Knowing the answer to each of these questions was important to me.

During my research, I quickly learned that there are hundreds of ATMs nearby that accept Cash App withdrawals. My next question was whether there is a free ATM for Cash App cards near me.

Now that I’ve learned the details, I’ll answer your burning questions about Cash App ATM withdrawals and share the names of 100+ bank ATMs you can visit to withdraw your funds from the app.

Related: How to Do Legitimate Cash App Flips

Cash App Card ATM Pros and Cons

Using Cash App card ATMs has many benefits, but there are also some cons to consider as well. Here is a snapshot of a few pros and cons to help you decide if the withdrawal process is worth it to you.

Pros

- You can withdraw Cash App funds from any ATM

- You can get the ATM fees reimbursed by setting up a direct deposit

Cons

- There are ATM withdrawal limits to consider

- There are ATM fees to consider

Continue reading to learn further details of each pro and con below.

Related: How to Design a Unique Cash App Card

Cash App ATM Withdrawal Limits

While I’ve never been a huge fan of ATM withdrawal limits, I understand that they are there for my protection. Cash App ATM withdrawal limits are no different. You can expect to withdraw up to $310 per transaction, a maximum of $1,000 in 24 hours, or a maximum of $1,000 every 7 days.

For example, you can withdraw $250 on Monday, Wednesday, Friday, and Sunday, which equals $1,000 in a 7-day period. You could not, however, withdraw $350 four times per week, since that puts you over the Cash App ATM withdrawal limit.

Another consideration to make is that using your Cash Card to receive Boosts (instant cash discounts or Bitcoin earnings on qualifying purchases) counts toward your ATM withdrawal limits. That means if you use your Cash Card to buy $75 worth of groceries each week to earn a $7.50 Bitcoin Boost, your new ATM withdrawal limit for the week is $925 ($1,000 minus $75).

Related: How to Use Cash App Under 18

Is There a Cash App Free ATM Near Me?

Before loading my Cash App Card, I knew it was important to learn what ATM is free for Cash App. It wouldn’t make sense for me to load the app with my funds if I had to pay to withdraw it.

It didn’t take me long to find out that Cash App doesn’t offer free ATM withdrawals. According to ValuePenguin, it costs between $1.50 and $3.50 in ATM fees for the average out-of-network withdrawal. Plus, Cash App charges a flat $2 fee per transaction.

While there is no free Cash App ATM near me, there is a way to get the ATM fees reimbursed. Cash App users have the option to set up direct deposits of paychecks into the app. As long as those direct deposits equal at least $300 each month, then Cash App will cover ATM fees for three withdrawals per month (up to $7 in fees each time).

You must activate free ATM withdrawals once your direct deposit hits your account. Each time you get a deposit of at least $300 in your Cash App account, it extends your 31-day window to receive ATM fee reimbursements.

Related: Cash App Taxes

100+ Cash App ATM Locations Near Me

If you want to use Cash App without connecting your bank account, rest assured that there is a bank on nearly every busy street that allows Cash App ATM withdrawals. You don’t have to be a customer of the bank in order to use its ATM to withdraw your funds. Find one on your way home from work, around the corner from Target, or on your walk to the park.

- Ally Financial

- American Express

- Ameriprise

- Ameris Bancorp

- Arvest Bank

- Associated Banc-Corp

- Atlantic Union Bank

- Bank of America

- Bank of Hawaii

- BankUnited

- Barclays

- BCI Financial Group, Inc.

- BMO Harris Bank

- BNP Paribas / Bank of the West

- BOK Financial Corporation

- Cadence Bank

- Capital One

- Cathay Bank

- Charles Schwab Corporation

- CIBC Bank USA

- CIT Group

- Citigroup

- Citizens Financial Group

- City National Bank

- Comerica

- Commerce Bancshares

- Credit Suisse

- Cullen/Frost Bankers, Inc.

- Customers Bancorp, Inc.

- Deutsche Bank

- Discover Financial

- East West Bank

- EB Acquisition Company II LLC

- EB Acquisition Company LLC

- Fifth Third Bank

- First BanCorp

- First Citizens BancShares

- First Hawaiian Bank

- First Horizon National Corporation

- First Midwest Bank

- First National of Nebraska

- FirstBank Holding Co

- Flagstar Bank

- FNB Corporation

- Fulton Financial Corporation

- Glacier Bancorp, Inc

- Goldman Sachs

- Hancock Whitney

- HSBC Bank USA

- Huntington Bancshares

- Investors Bank

- John Deere Capital Corporation

- JPMorgan Chase

- KeyCorp

- M&T Bank

- Macy’s

- MidFirst Bank

- Mizuho Financial Group

- Morgan Stanley

- MUFG Union Bank

- New York Community Bank

- Northern Trust

- Old National Bank

- Pacific Premier Bancorp Inc.

- PacWest Bancorp

- People’s United Financial

- Pinnacle Financial Partners

- PNC Financial Services

- Popular, Inc.

- Prosperity Bancshares

- Raymond James Financial

- RBC Bank

- Regions Financial Corporation

- Santander Bank

- Simmons Bank

- SMBC Americas Holdings Inc.

- South State Bank

- State Farm

- State Street Corporation

- Sterling Bancorp

- Stifel

- SVB Financial Group

- Synchrony Financial

- Synovus

- TD Bank, N.A.

- Texas Capital Bank

- The Bank of New York Mellon

- TIAA

- Truist Financial

- U.S. Bancorp

- UBS

- UMB Financial Corporation

- Umpqua Holdings Corporation

- United Bank (West Virginia)

- USAA

- Valley National Bank

- Washington Federal

- Webster Bank

- Wells Fargo

- Western Alliance Bank

- Wintrust Financial

Find even more banks listed on The Federal Reserve‘s website.

Related: Best Cashtags for Business or Personal Use

Withdraw Your Cash App Funds From Any ATM

When it comes down to it, you can make a Cash App ATM withdrawal at any bank. Cash App partners with Sutton Bank to give customers complete access to their cash at any other bank’s ATM.

While it’s not free to withdraw Cash App funds from an ATM, I’ve learned some tips to help avoid those fees. First, consider setting up a direct deposit of at least $300 per month into your account. Then, activate free ATM withdrawals to get up to $7 in fees reimbursed per transaction, three times per month.

Instead of using cash to shop and buy food, you can avoid Cash App ATM fees by using your Cash Card anywhere that takes Visa cards. You can also invite anyone you owe money to join the app and send it to them through the app. The more you use Cash App to pay money digitally, the less you’ll need to withdraw from Cash App ATMs and get hit with ATM fees and withdrawal limits.

Ultimately, I didn’t find a free ATM for Cash App card near me. But with the tips and strategies I’ve learned along the way, I know there are options to avoid fees and still have quick access to my funds. The easiest way for me is to transfer the money in my account to my bank and then use my debit card at my bank’s ATM to withdraw cash when I need it. It’s an extra step, but at least it’s free.

Related: Best Cash App Alternatives

![Cash App Free Money Code [2024 Bonus] NMXPRV7](https://payapphome.com/wp-content/uploads/2020/12/Woman-viewing-Cash-App-on-smartphone.jpg)